Mortgage Glossary

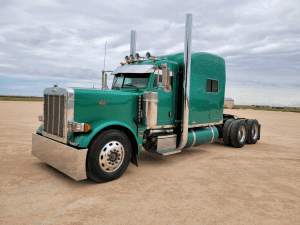

The Road to Growth: How Equipment Financing Can Propel Your Trucking Business

Published:February 16, 2024 Modified:February 16, 2024Embarking on the journey of expanding your trucking business is an exciting endeavor. As your fleet grows, so do increased profits and market presence opportunities. However, acquiring and maintaining a fleet of 18-wheelers involves a

Start Strong, Stay Stronger: The Importance of Working Capital for New Businesses

Published:February 16, 2024 Modified:February 16, 2024Starting a new business is an exciting venture filled with aspirations and dreams of success. However, navigating the intricate landscape of entrepreneurship demands more than just passion; it requires strategic planning, resilience and adequate financial

Securing Your Business’s Future: A Deep Dive into Commercial Loan Requirements

Published:February 16, 2024 Modified:February 16, 2024Running a successful business often requires strategic financial planning, and securing the right commercial loan can play a pivotal role in your company’s growth and stability. At Hub City Lending, we understand the unique needs

The Road to Growth: How Equipment Financing Can Propel Your Trucking Business

Published:January 9, 2024 Modified:January 9, 2024Embarking on the journey of expanding your trucking business is an exciting endeavor. As your fleet grows, so do increased profits and market presence opportunities. However, acquiring and maintaining a fleet of 18-wheelers involves a

Startup Lifeline: The Role of Working Capital Loans in Business Resilience

Published:January 4, 2024 Modified:January 4, 2024Navigating through a myriad of challenges in the business landscape, startups often discover a critical factor that can make or break their journey: working capital. The heartbeat of any business, working capital is the fuel

Financing Your Future: Why Texas Mortgage Brokers Are Key to Smart Homeownership

Published:December 29, 2023 Modified:February 16, 2024Owning a home is a dream for many, but the path to homeownership can be filled with challenges, especially when navigating the complex world of mortgages. In Texas, where the real estate market is thriving,

Maximizing Growth: How Working Capital Loans Fuel Business Expansion

Published:December 28, 2023 Modified:February 16, 2024Are you a business owner eager to propel your enterprise to new heights? Working capital is one crucial factor that often determines the speed and scale of growth. At Hub City Lending, we understand the

The Importance of a Business Plan in Obtaining a Texas Commercial Loan

Published:November 9, 2023 Modified:November 9, 2023 If you are a business owner or entrepreneur in Texas seeking financing for your commercial venture, you understand the significance of securing the right loan to fuel your growth. Commercial loans in Texas are

Why Consider Heavy Equipment Collateral Loans for Your Business?

In the fast-paced world of business, access to capital is often the key to success. Whether you are a construction company looking to expand your fleet or a manufacturing business in need of new machinery, financing can be a critical

Finding Financial Stability: How Small Business Working Capital Loans Help

In today’s dynamic business landscape, maintaining financial stability is crucial for the success and growth of small businesses. Whether you’re a startup looking to establish your presence or an established company seeking to expand, having access to working capital is

Building Your Business with First-Time Semi Truck Financing

If you’re a small business owner in the trucking industry, you understand the significant role semi-trucks play in your operations. They are the lifeblood of your business, transporting goods and ensuring timely deliveries. However, acquiring your first-time semi-truck can be

The Role of a Commercial Mortgage Lender in Real Estate Financing

Published:October 9, 2023 Modified:October 9, 2023 In the complex world of real estate financing, the expertise of a commercial mortgage lender can be invaluable. These financial professionals play a pivotal role in assisting businesses to secure the funding they need

Understanding the Basics: What Is a Working Capital Loan Exactly?

Published:October 9, 2023 Modified:October 9, 2023 In the world of business finance, understanding the fundamentals is crucial for making informed decisions that can propel your company forward. One key aspect of business financing that often comes into play is working

The Significance of a Co-Signer in Bad Credit Semi Truck Financing

Published:September 14, 2023 Modified:September 20, 2023 In the world of business, the road to success often requires navigating financial challenges, especially when it comes to securing financing for essential assets like semi-trucks. While having a strong credit history is typically

The Importance of Budgeting for Your First Semi-Truck Purchase

Published:September 12, 2023 Modified:September 20, 2023 The Importance of Budgeting for Your First Semi-Truck Purchase Are you considering making your first semi-truck purchase? Congratulations on taking this significant step toward expanding your business and entering the trucking world. Before you

The Benefits of Using a Commercial Mortgage Broker vs. Going Direct

Published:September 11, 2023 Modified:September 20, 2023 In the complex world of commercial real estate, securing the right financing can be daunting. Business owners and property investors often face the decision of whether to approach a lender directly or enlist the

The Benefits of Invoice Factoring for Small Business Cash Flow

Published:September 6, 2023 Modified:September 6, 2023 Cash flow management is a critical aspect of running a successful small business. Timely access to funds is essential for covering operating expenses, investing in growth, and ensuring the sustainability of your enterprise. For

The Role of Credit Score in Securing a Small Business Loan in Texas

Published:September 6, 2023 Modified:September 6, 2023 When it comes to securing a small business loan in Texas, your credit score plays a pivotal role in determining your eligibility and the terms you’ll receive. At Hub City Lending, we understand the

Investing in Your Future: The Advantages of Truck Equipment Financing

Published:August 7, 2023 Modified:August 7, 2023If you are a trucking business owner or an independent trucker looking to expand your fleet or upgrade your equipment, you may have considered the option of financing your trucking equipment. In this blog post,

Choosing the Best Semi Truck Finance Option: Let our Calculator Be Your Guide

Published:August 7, 2023 Modified:August 7, 2023Welcome to the official blog of Hub City Lending! Today, we are here to discuss an essential aspect of the trucking industry: choosing the best semi-truck finance option. As a leading financial services provider, we

Boost Your Cash Flow with Our Factoring Services in Texas

Published:July 17, 2023 Modified:July 31, 2023 Are you a business owner in Texas looking to improve your cash flow? Are you tired of waiting for your customers to pay their invoices while your expenses continue to pile up? At Hub

The Importance of Down Payments in Commercial Real Estate Financing

Published:July 17, 2023 Modified:July 31, 2023 When it comes to financing commercial real estate, understanding the importance of down payments is crucial. At Hub City Lending, we have a team of highly experienced and certified financial professionals who can guide

The Advantages of Using a Commercial Mortgage Broker for Your Property Financing

Published:July 17, 2023 Modified:July 31, 2023 When it comes to financing your commercial property, navigating the complex landscape of lenders, loan options, and terms can be overwhelming. That’s where a commercial mortgage broker can be your trusted partner. At Hub

Is Zero Down Semi Truck Financing Right for Your Business? Find Out Here

Published:July 17, 2023 Modified:July 31, 2023 As a business owner in the trucking industry, acquiring a semi-truck is a significant investment that can drive growth and success. At Hub City Lending, we understand the importance of finding the right financing

Unlocking Opportunities: How to Finance a Semi Truck for Business Growth

Published:July 17, 2023 Modified:July 31, 2023 Are you a trucking business owner looking to expand your fleet and take advantage of growth opportunities? Financing for a semi-truck can be a significant step towards achieving your business goals. However, navigating the

Fueling Your Business’s Growth: The Role of Permanent Working Capital Loans

Published:June 14, 2023 Modified:July 20, 2023 At Hub City Lending, we understand that fueling your business’s growth requires adequate financial resources. That’s why we offer permanent working capital loans, a powerful financing solution designed to provide the necessary funds for

Understanding the Benefits of Zero Down Financing for Semi Trucks

Published:June 14, 2023 Modified:June 14, 2023 If you’re in the market for a semi-truck, you’re likely aware of the high costs of purchasing one. However, with the availability of zero-down financing options, acquiring a semi-truck for your business has become

Roadmap to Success: How to Finance Your First Semi Truck Like a Pro

Published:June 7, 2023 Modified:July 10, 2023 Roadmap to Success: How to Finance Your First Semi Truck Like a Pro At Hub City Lending, we understand that knowing how to finance a semi-truck is a crucial step toward achieving your business

How Bridge Loans in Texas Can Help Facilitate Smooth Property Transitions

Published:June 7, 2023 Modified:July 10, 2023 When it comes to real estate transactions, timing is often a critical factor. Whether you want to purchase a new property or sell an existing one, there can be instances where you find yourself

The Advantages of Small Business Invoice Factoring for Financial Stability

Published:June 7, 2023 Modified:July 10, 2023 Maintaining a persistent cash flow is crucial for success when managing a small business’s finances. However, waiting for clients to pay their invoices can create cash flow gaps and hinder business operations. That’s where

What is FHA Eligibility?

Published:February 6, 2023 Modified:February 6, 2023 What Determines FHA Eligibility? Buying a home is often the largest purchase most people will ever make. With the cost of housing rising, it’s important to consider all potential methods of financing such a

Debt service coverage ratio

Published:September 27, 2022 Modified:February 6, 2023 What Is Debt Service Coverage Ratio? The debt service coverage ratio (DSCR) is a crucial indicator of a company’s capacity for loan repayment, acquisition of fresh capital, and dividend distribution. It is one of

Investor

Published:September 10, 2022 Modified:February 6, 2023 What are Investors? Individuals or entities (such as businesses or mutual funds) who invest money with the hope of making a profit are called investors. Investors depend on a variety of financial instruments to

Real estate investing

Published:September 2, 2022 Modified:February 6, 2023 What Is Real Estate Investing? It is possible to invest in real estate by buying, managing, renting out, or selling properties for a profit. Investing in real estate, either actively or passively, is the

Loan to value ratio

Published:September 2, 2022 Modified:February 6, 2023 What Is Loan To Value Ratio? Financial institutions and other lenders assess the loan-to-value (LTV) ratio as a gauge of the lending risk prior to accepting a mortgage. Loans with high LTV ratings are

Liquid asset

Published:August 30, 2022 Modified:February 6, 2023 What are the Liquid Assets? Liquid assets are those that can be swiftly and readily converted into cash. Examples of liquid assets include cash, money market instruments, and marketable securities. Tracking liquid assets as

Annual revenue

Published:August 19, 2022 Modified:February 6, 2023 What Is An Annual Revenue? The total amount of money a business brings in each year from the sale of goods, services, assets, or capital is known as annual revenue. Your annual revenue does

Financial statement

Published:August 19, 2022 Modified:February 6, 2023 What Are Financial Statements? A financial statement is a document detailing the activities and financial success of a firm. Government organizations, accounting companies, etc. routinely perform a review of financial statements to ensure accuracy

Hard money

Published:August 14, 2022 Modified:February 6, 2023 Hard money meaning A common form of lending in real estate investing is called hard money. Other names for hard money loans are asset-based loans, bridge loans, and STABBL loans (short-term asset-backed bridge loans).

Face value

Published:August 14, 2022 Modified:February 6, 2023 What Is A Face Value? A financial concept known as “face value” refers to a security’s nominal or monetary value as indicated by its issuer. The original cost of the stock, as stated on

Loan term

Published:August 5, 2022 Modified:February 6, 2023 What Is A Loan Term? The length of a loan, or the time it takes to be fully repaid when the borrower is making scheduled payments, is referred to as the loan term. The

Receivables

Published:July 26, 2022 Modified:February 6, 2023 What Are Receivables? Receivables, also known as accounts receivable, are sums owing to a business by its clients for products or services that have already been provided or utilized but have not yet been

Invoice

Published:July 26, 2022 Modified:February 6, 2023 What Is An Invoice? A time-stamped commercial document known as an invoice lists the specifics of a transaction between a buyer and a seller and records it. The invoice often details the conditions of

Balance Sheet

Published:July 22, 2022 Modified:February 6, 2023 What is a Balance Sheet? A balance sheet in financial accounting is a summary or list of financial balances for an individual or company. It can be sole proprietorship, business partnership, corporation, private limited

Funding

Published:July 22, 2022 Modified:February 6, 2023 What Is Funding? The purpose of a fund is to set aside funds for a specific purpose. For instance, a municipal government can create a fund to build a new civic center, a college

Down payment

Published:July 13, 2022 Modified:February 6, 2023 What Is A Down Payment? A down payment is a quantity of money that a buyer pays at the beginning of a pricey good or service purchase. A portion of the entire purchase price

Investment

Published:July 7, 2022 Modified:February 6, 2023 What Is An Investment? A purchase made with the intention of creating income or capital growth is known as an investment. An asset’s value increasing over time is referred to as appreciation. When a

Credit score

Published:July 7, 2022 Modified:February 6, 2023 What Is A Credit Score? A credit score is a three-digit figure that ranges from 300 to 850 and is used to determine your credit risk, or how likely you are to make on-time

Obligation

Published:June 30, 2022 Modified:February 6, 2023 What is an Obligation? Simply, obligation refers to the responsibility of a party to fulfill the contractual terms and conditions. In case, the obligation is not met, the legal system often provides recourse for

Leasing

Published:June 30, 2022 Modified:February 6, 2023 What Is Leasing? A lease is a legally binding agreement between two parties in which one commits to rent property owned by the other on particular terms. It allows a tenant or lessee to

Interest rate

Published:June 22, 2022 Modified:February 6, 2023 What is an Interest Rate? In addition to the principal, the interest rate refers to how much a lender charges the borrower for the use of assets. The money generated from a credit union

Cash flow

Published:June 22, 2022 Modified:February 6, 2023 What is Cash Flow? Cash Flow is net balance of cash coming into and out of a business at a certain point in time. A business’s cash is continually flowing in and out. When

Asset

Published:June 15, 2022 Modified:February 6, 2023 What is an Asset? The term asset refers to a type of economic advantage that people or entities have today, tomorrow, or in the future. Consequently, an asset is anything that you own

Renovation

Published:June 15, 2022 Modified:February 6, 2023 What is a Renovation Renovation means to “create new again”—to “revitalize.” The process of renovating (also known as remodeling) a broken, damaged, or outmoded structure. Commercial and residential renovation are the most common types

Finance committee

Published:June 9, 2022 Modified:February 6, 2023 What is a Finance Committee? The Finance Committee oversees the organization’s budget and provides financial analysis, guidance, and monitoring. Their main role is to guarantee that the organization has the financial resources it requires

Donation

Published:June 2, 2022 Modified:February 6, 2023 What are Donations? Individuals, businesses, and other organizations can make donations to support the organization’s mission and objectives. They also provide funds to enable organizations to continue providing high-quality programs for the community. Each

Credit

Published:June 2, 2022 Modified:February 6, 2023 What is the meaning of Credit? This term has many meanings in the financial world, but credit is generally defined as a contract agreement in which a borrower receives a sum of money or

Fundraising

Published:May 30, 2022 Modified:February 6, 2023 What is Fundraising? Fundraising is the process of soliciting and collecting voluntary financial contributions from individuals, businesses, charitable foundations, or government agencies. Although fundraising is most commonly associated with efforts to raise funds for

Charity

Published:May 27, 2022 Modified:February 6, 2023 What is a Charity? Charities are organizations whose primary goals are charity and social well-being. charitable, educational, religious or any other activity serving the public interest or common benefit. There are many legal differences

Budget

Published:May 25, 2022 Modified:February 6, 2023 What a Budget? Budgets are an estimate of future revenue and expenses. They are usually prepared and re-evaluated periodically. A budget can be created for an individual, a group, a company, a government or

Capital

Published:May 20, 2022 Modified:February 6, 2023 What is Capital? Capital in the form of money or other assets owned by a person or organization or available or contributed for a particular purpose such as starting a company or investing. Capital

Nonprofit

Published:May 19, 2022 Modified:February 6, 2023 What a Nonprofit? A nonprofit organization (NPO), also known as a non-business entity,not-for-profit organization, or nonprofit institution,is a legal entity organized and operated for a collective, public or social benefit, in contrast with an